Real-Time API Integration for FedNow® and RTP® Good Funds Gateway

To deliver a secure, API-based real-time payment gateway that empowers businesses to collect FedNow® and RTP® Good Funds instantly, with full support for batch, recurring, and mobile-triggered transactions.

TodayPayments.com is the fintech gateway for instant settlement and real-time cash flow. Through our developer-friendly Real-Time API, we help businesses automate FedNow® and RTP® transactions, request payments via hosted pages, and eliminate delays across every touchpoint—POS, MOTO, or ecommerce.

Batch, Recurring, and One-Time Payments Using Real-Time Rails

The Power of Real-Time Payments—Now Available via API

Speed, certainty, and automation are the pillars of modern business payments. The ability to send and receive money in real time—with finality, transparency, and rich data—is no longer a luxury. It’s the new standard. With the TodayPayments.com Real-Time API, you can connect directly to the FedNow® and RTP® networks, triggering Good Funds transactions across POS, MOTO, or ecommerce channels with no delays or chargebacks.

Whether you’re uploading ISO 20022-compliant batch files, triggering payments via a mobile app, or automating RfP™ invoicing, our real-time gateway gives your business full control, visibility, and settlement certainty.

TodayPayments.com’s Real-Time API allows businesses to send Requests for Payment (RfPs) and receive irrevocable Good Funds instantly using FedNow® and RTP® payment rails. Whether it’s a one-time invoice, a subscription billing cycle, or a multi-line batch upload, the system supports ISO 20022 message formats and automates delivery via secure hosted payment pages.

This gateway ensures compatibility with all U.S. banks and credit unions while integrating seamlessly into your existing payment, accounting, and delivery systems—no matter your vertical.

Attributes of Real-Time API for your business using instant payments

How the Real-Time Payments API Works

- Merchant Integration

Businesses connect to the TodayPayments.com API using JSON/XML or plug-and-play QBO sync tools. - Transaction Creation

The system creates a Request for Payment (RfP™) using ISO 20022 data elements, either manually or in batch. - RfP Sent to Payer

Customers receive a secure, hosted payment link via email, SMS, or invoice. - Payment Authorization

The customer authorizes the payment from their banking app, card, ACH, or BNPL provider. - Instant Good Funds Settlement

Funds are delivered in real time via FedNow® or RTP®, and settlement is confirmed. - Ledger Update and Tracking

Payment is reconciled automatically in the merchant’s ledger (e.g., QBO, ERP, CRM), and confirmation is sent to all parties.

Real-Time Payment Parameters, Features & SEO-Rich Benefits

Core Parameters

- Networks Supported: FedNow® and RTP®

- Integration Channel: JSON, XML, QBO, ERP APIs

- File Format Support: ISO 20022 XML, JSON, Excel

- Transaction Types: A2A, B2B, C2B – One-Time & Recurring

- Settlement Time: Real-Time (sub-10 seconds)

- Payment Triggers: POS, MOTO, Ecommerce, Subscription Billing

- Funds Status: Irrevocable Good Funds – No Chargebacks

- Ledger Integration: Auto-sync to AR/accounting systems

Key Real-Time Payment API Features

1. Payee-Initiated Request for Payments (RfPs)

Merchants send RfPs via the API, triggered by delivery, invoice generation, or billing cycles.

2. Network Compatibility

Supports all U.S. financial institutions via FedNow® and RTP®.

3. Alias-Based MID Assignment

Assign Merchant IDs to specific agents, departments, or vendors using phone numbers or email aliases.

4. Hosted Payment Pages

No coding required. Each RfP includes a secure, branded payment page optimized for mobile and desktop.

5. ISO 20022 Compliance

Upload structured remittance files using Excel, XML, or JSON with globally accepted banking standards.

6. Real-Time AR Reconciliation

Once funds arrive, AR ledgers are updated, and real-time dashboards reflect payment status automatically.

Ask us How:

- Integrate a Real-Time API for FedNow® and RTP® to send RfPs and receive Good Funds instantly for POS, MOTO, or ecommerce transactions.

- TodayPayments.com’s real-time payment gateway supports ISO 20022 message formats and enables merchants to upload batch files in Excel, XML, or JSON.

- Each Request for Payment (RfP™) includes a hosted payment page, allowing payers to authorize transactions through mobile banking apps, ACH, cards, or BNPL providers.

- The Good Funds model ensures that merchants receive final, irrevocable payment instantly—eliminating chargebacks and delayed settlements.

- With support for alias-based MIDs, multi-division companies can track payments by team, service, or client, while reconciling data into QBO or ERP platforms in real time.

- Recurring subscription payments, mobile delivery collections, and digital invoicing are all supported by our API-first real-time platform.

- Unlike traditional ACH and wire, RTP® and FedNow® offer always-on availability—ideal for 24/7 operations.

Why Businesses Choose TodayPayments.com for Real-Time Payments API

- Enable payee-initiated RfPs using ISO 20022

- Integrate with FedNow® and RTP® for Good Funds in real time

- Send SMS, email, or invoice-triggered hosted payment pages

- Upload batch files in Excel, JSON, or XML for recurring payments

- Assign alias-based MIDs for better organizational tracking

- Eliminate chargebacks and AR aging with real-time reconciliation

- Onboard entirely online—no bank visit or hardware required

Implementing interoperability between FedNow, RTP (Real-Time Payments), and various payment channels like digital POS, E-commerce, and MOTO (Mail Order/Telephone Order) through Real-TimePayments.com can greatly enhance the efficiency and responsiveness of payment systems. Utilizing the Real-Time API provided by Real-TimePayments.com, businesses can ensure seamless transaction processing across different platforms. Here's how this can be achieved:

Overview of the Integration Process

- API Integration: The first step is integrating the Real-Time API from Real-TimePayments.com into the existing payment systems of the business. This API will facilitate the connection between the merchant's platforms (POS, E-commerce, MOTO) and the RTP and FedNow networks.

- Interoperability Setup: Ensure that the API is capable of handling multiple payment protocols (FedNow and RTP) and can seamlessly switch or choose between them based on the transaction requirements and network availability.

- Security Measures: Implement robust security measures to protect transaction data and comply with financial regulations. This includes encryption, secure authentication, and continuous monitoring of transactions.

Application Across Various Channels

- Digital POS: For point-of-sale systems in physical stores or at events, the Real-Time API can enable immediate payment processing. This setup reduces wait times for customers and improves the transaction flow, enhancing customer satisfaction.

- E-commerce: Integrate the Real-Time API into the checkout processes of online stores. This allows customers to make instant payments using their preferred bank accounts, connected via FedNow or RTP, providing a frictionless shopping experience.

- MOTO: For sales conducted over the phone or by mail, the API can process payments immediately as orders are taken. This capability is especially valuable for businesses that deal with high call volumes or remote sales, as it ensures quick and secure transaction processing.

Technical Considerations

- Multi-Protocol Support: The API should be designed to handle different types of payment protocols, ensuring compatibility with both FedNow and RTP. This includes handling unique aspects of each protocol, such as message formats and response handling.

- Transaction Monitoring and Reporting: Implement real-time monitoring and reporting capabilities to track every transaction processed through the API. This helps in quickly resolving any issues and provides valuable data for improving service performance.

- Scalability and Performance: Ensure that the API and its implementation are scalable to handle increasing volumes of transactions, especially during peak times for E-commerce and POS transactions.

- Compliance and Regulatory Adherence: Regularly update the system to comply with the latest financial regulations and standards, including those specific to RTP and FedNow networks. This includes privacy regulations concerning customer data.

Benefits of Using Real-TimePayments.com API

- Speed and Reliability: Transactions are processed in real-time, which is crucial for maintaining cash flow and customer trust.

- Reduced Costs: By using direct bank transfers through RTP and FedNow, merchants can avoid the higher fees associated with traditional credit card networks.

- Enhanced Customer Experience: Providing customers with quick and easy payment options can lead to increased satisfaction and loyalty.

Want to automate payments and get paid in real time—without chargebacks, delays, or manual reconciliation?

At TodayPayments.com, we help merchants, platforms, and enterprises activate a Real-Time API for FedNow® and RTP®, enabling secure, programmable access to Good Funds with ISO 20022 support and hosted RfP™ pages.

✅ One-time and recurring

real-time payments

✅ Full ISO 20022 batching

support

✅ Works with POS, MOTO, ecommerce, and

apps

✅ Syncs with QBO, ERP, and mobile platforms

✅ API-first infrastructure for scalability

👉 Visit

TodayPayments.com to launch your Good Funds Gateway API

for real-time payments today.

Send. Settle. Sync. Secure. In

Seconds.

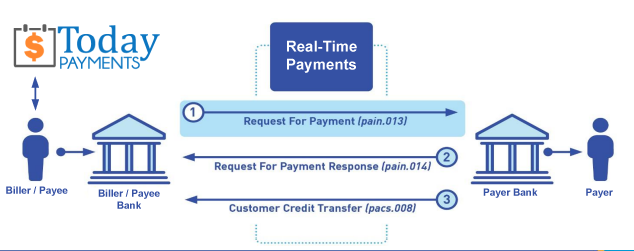

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Instant Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Real-Time API system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing